Looking to understand the financial performance of your business? Review our guide to Profit & Loss statements and get a head start in preparing one with our free downloadable profit and loss statement templates.

A profit and loss statement, or P&L statement, is a financial document that helps you understand your business’s profitability over time. By contrasting your business income with your expenses, profit and loss statements help track your overall profits and identify periods of loss.

A P&L statement includes three primary sections: business expenses (money going out), revenue (money coming in), and net income (the difference between the two, commonly referred to as your profit margin).

Small businesses often use profit and loss statements to demonstrate their profitability to potential investors or when applying for a bank loan. P&L statements are one of the essential financial statements for businesses, along with balance sheets and cash flow statements. They are necessary for proving the status your business finances, and an important tool for you to assess whether your business is in the black (profitable) or the red (operating at a loss).

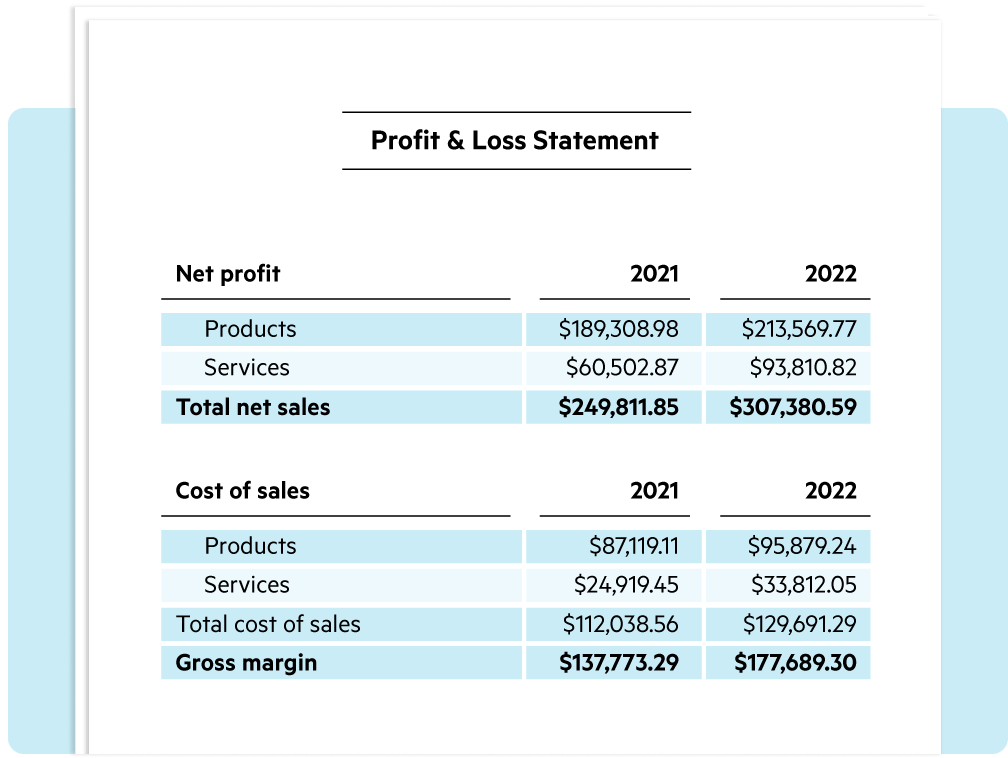

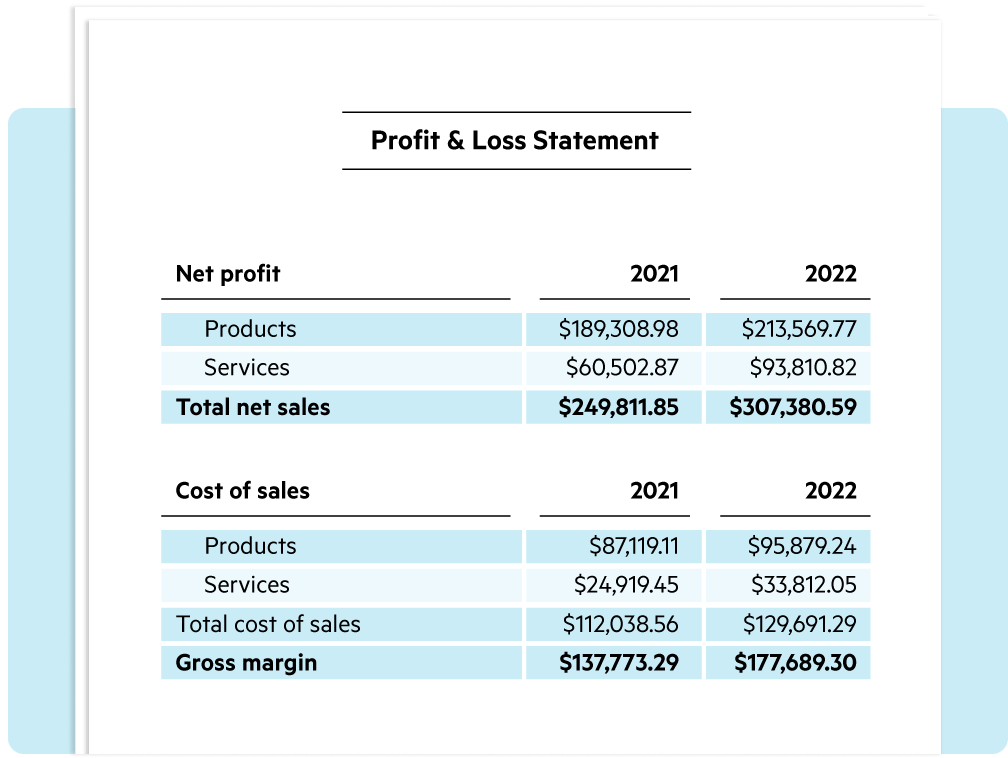

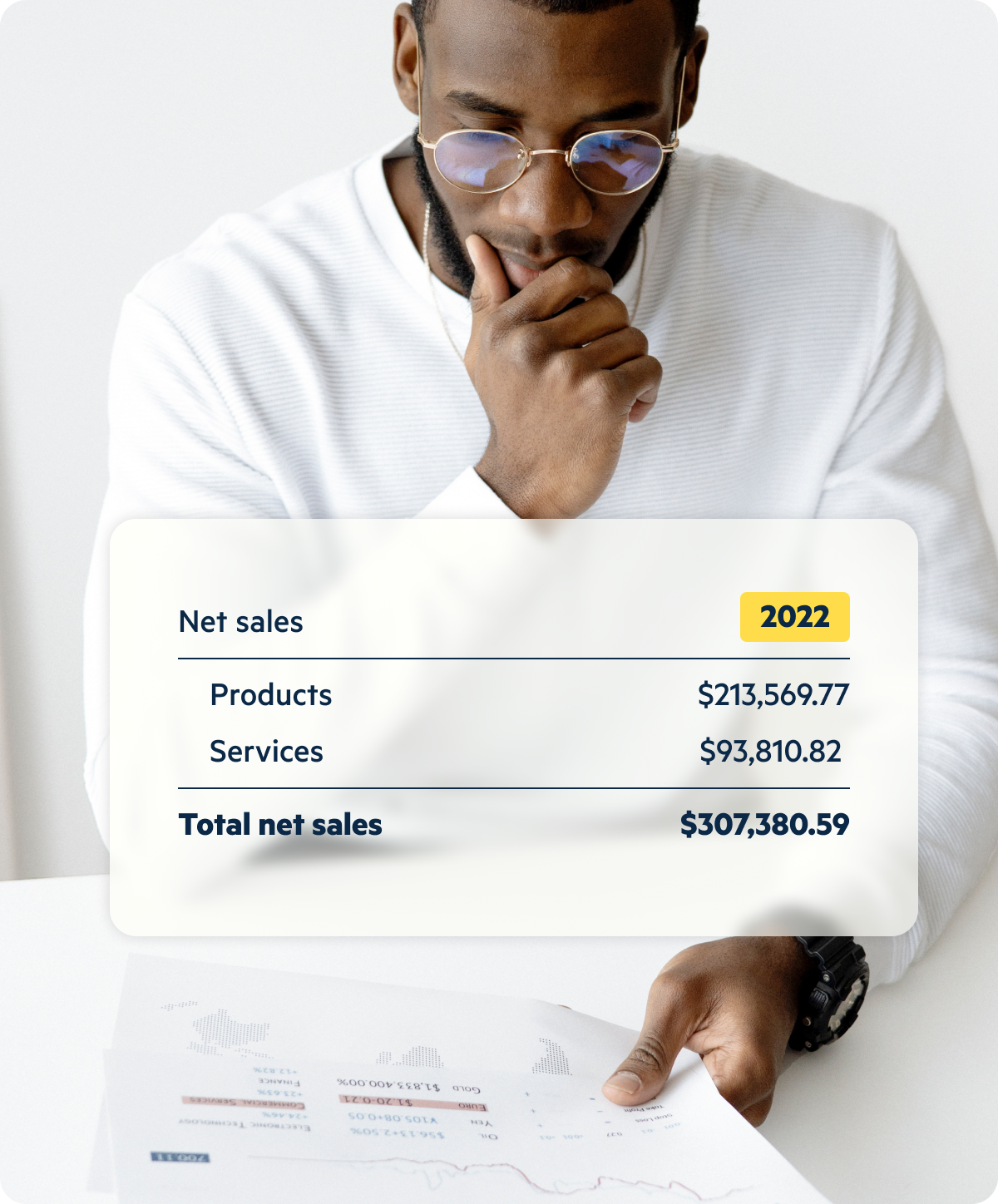

Creating a Profit and Loss statement for the first time can be overwhelming, but you can use this example to understand how a P&L statement should look.

Get a better idea about how to evaluate your business’s profitability with this P&L statement example.

Analyzing the financial performance of your business doesn’t have to be overly complicated. This simple profit and loss statement template offers a straightforward structure, including a reporting date range, a list of common line items, and built-in formulas to sum up revenue and expenses.

Just plug in your numbers for the defined reporting period and get an instant assessment of the financial health of your business.

When your business achieves a level of growth that necessitates a more in-depth profit and loss report, a multi-step P&L statement is likely more appropriate. This statement type separates operating revenue and expenses from non-operating revenue and expenses, providing an understanding of how the core activities of a business impact revenue and expenses, versus its non-essential activities.

A multi-step P&L statement enables you to calculate gross profit and operating income, which can be especially useful for external investors evaluating a business.

Creating a Profit and Loss statement for the first time can be overwhelming, but you can use this example to understand how a P&L statement should look.

Get a better idea about how to evaluate your business’s profitability with this P&L statement example.

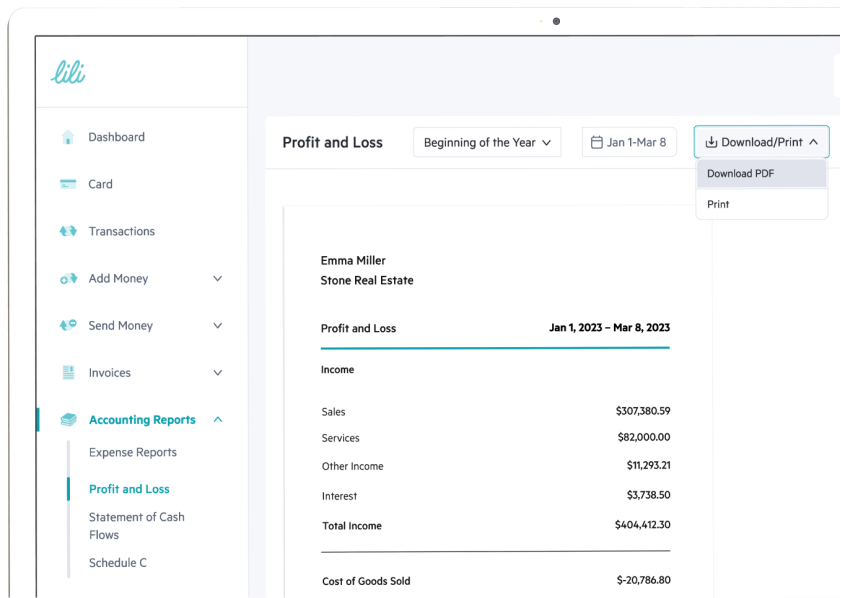

Lili’s Accounting Software automatically generates financial reports based on your transaction categorization, including Profit & Loss statements.

Determine the period of time for which you need to create a profit and loss statement. This can be anything from a month to a financial quarter or even a year.

Identify all revenue and expenses for the selected period of time, and input this information into your P&L statement template.

All of our free profit and loss statement templates are customizable to your needs! Edit or remove line items that are not relevant to your business, or add in lines as you go to fit with unique revenue sources and business expenses.

Don’t assume the formulas are acting as they should! Double check formulas for fields such as Total Expenses and Net Profit, making sure the calculations are filling correctly.

Save a copy of this P&L statement for your business records, or convert it to a PDF and share with the appropriate parties (e.g. an investor or lender).

A profit and loss statement is helpful for your own understanding of your business’s financial health. It is a quick way to check whether your business is operating at a profit or a loss, helps you review expenses to understand where you can increase spend (or where you need to cut costs), and helps you check in on the quality of your profit margin.

P&L statements are also a helpful way to outline your business’s current and projected profitability to any outside entities that may require it. Investors will want to see that you are operating at a profit, or have a pathway to future profitability. Lenders will need to see where your business is at financially right now, and how you plan to improve in the future. Business finances naturally will ebb and flow, and a profit and loss statement can demonstrate how these changes pan out over time.

A profit and loss statement includes a number of elements that are relevant to your business finances, including:

Your total business revenue for the given period of time. This may look different depending on your accounting processes and the type of business you are running.

Expenses associated with producing the products or services you provide, such as raw materials, employee wages, and shipping expenses.

Operating expenses related to selling and marketing, and administrative expenses associated with your business that are not directly related to the production of goods or services. Examples of such expenses include rent, advertising, and software subscriptions.

Your pre-tax income.

Net income divided by the number of shares for the given period of time.

Value lost by depreciating assets such as equipment, inventory, vehicles, and property during the specified period of time.

Earnings for the selected period of time after subtracting all internal costs, but before subtracting external costs (interest, tax, depreciation, and amortization).

Yes, you can create your own profit and loss statement! A P&L statement can be manually prepared either by starting from scratch, or by using a statement template, like the downloadable statements templates available above.

Yes, an income statement is the same as a Profit and Loss statement. “Profit and Loss statement” and “income statement” are often used interchangeably , as they are both financial statements whose purpose is to summarize the financial performance of a business during a specific financial period in order to determine its profitability.

To read and understand your profit and loss statement, you should be intimately familiar with the primary metrics of your business, including revenue and expenses. However, in order to understand a P&L statement, you need to think strategically in order to put the numbers into the proper context.

Consider how a potential investor or lender would view your profits and losses, and use the following questions as guiding points to help you evaluate the financial state of your business:

Yes, you can create your own profit and loss statement! A P&L statement can be manually prepared either by starting from scratch, or by using a statement template, like the downloadable statements templates available above.

Simplify your bookkeeping with instant transaction categorization, and gain clarity about your business’s financial status with income & expense insights and auto-generated financial reports. Make it easier to balance your books with Lili’s Accounting Software.

Fill in some basic personal information.

Tell us about your businessShare a few details including business type, EIN and industry.

Select a planChoose the account plan that best fits your business.

Contact Us

Mon – Friday, 9am – 8pm EST

About LiliLili is a financial technology company, not a bank. Banking services are provided by Choice Financial Group, Member FDIC, or Sunrise Banks, N.A., Member FDIC. The Lili Visa® Debit Card is issued by Choice Financial Group, Member FDIC, or Sunrise Banks, N.A., Member FDIC, pursuant to a license from Visa U.S.A., Inc. Please see the back of your Card for its issuing bank. The Card may be used everywhere Visa debit cards are accepted.

Wire Transfer service provided by Column Bank N.A., Member FDIC. All wires are subject to acceptance criteria and risk-based review and may be rejected at the sole discretion of Column Bank N. A. or Lili App Inc.

1 Available to Lili Pro, Lili Smart, and Lili Premium account holders only, applicable monthly account fee applies. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.

2 Available to Lili Smart and Lili Premium account holders only, applicable monthly account fee applies. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.

3 The Annual Percentage Yield (“APY”) for the Lili Savings Account is variable and may change at any time. The disclosed APY is effective as of September 1, 2023. Must have at least $0.01 in savings to earn interest. The APY applies to balances of up to and including $100,000. Any portions of a balance over $100,000 will not earn interest or have a yield. Available to Lili Pro, Lili Smart, and Lili Premium account holders only.

4 BalanceUp is a discretionary overdraft program for debit card purchases only, offered for Lili Pro, Lili Smart, and Lili Premium Account holders. You must meet eligibility requirements and enroll in the program. Once enrolled, your Account must remain in good standing with a deposit and spending history that meets our discretionary requirements to maintain access to the feature. BalanceUp overdraft limits of $20-$200 are provided at our sole discretion, and may be revoked any time, with or without notice.

5 Early access to ACH transfer funds depends on the timing of payer’s submission of transfers. Lili will generally post these transfers on the day they are received which can be up to 2 days earlier than the payer’s scheduled payment date.

6 Up to $1,000 per 24 hours period and a maximum of $9,000 per month. Some locations have lower limits and retailer fees may vary ($4.95 max). Note that Lili does not charge transaction fees.

7 Lili AI and other reports related to income and expense provided by Lili can be used to assist with your accounting. Final categorization of income and expenses for tax purposes is your responsibility. Lili is not a tax preparer and does not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors regarding your specific situation.

8 Lili does not charge debit card fees related to foreign transactions, in-network ATM usage, or card inactivity, or require a minimum balance. The Lili Visa® Debit Card is included in all account plans, and remains fee-free with the Lili Basic plan. Applicable monthly account fee applies for the Lili Pro, Lili Smart, and Lili Premium plans. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.

9 The Mail a Check, Outgoing Wire Transfers and Invite Your Accountant features are only available for Lili business deposit accounts opened through Sunrise Banks, N.A., Member FDIC.

© 2024 Lili App Inc. All Rights Reserved.